Sonder by Marriott Bonvoy: How Failed Tech Integration Led to Bankruptcy

How does a company that once flirted with a two billion dollar valuation end up in Chapter 7 liquidation after a single failed partnership? In Sonder’s case, the answer sits at the intersection of hospitality, legacy hotel systems, and a tech integration that never really worked.

Sonder’s bankruptcy has already made global headlines: stranded guests, sudden evictions, and a Marriott-backed partner that ran out of cash and options. Coverage from outlets like CBC and BBC has highlighted the human impact, the abrupt collapse of the Sonder by Marriott Bonvoy partnership and the fallout from delayed integrations with Marriott’s booking infrastructure.

This post goes deeper than the headlines. You will see how the Sonder by Marriott Bonvoy deal turned into a case study in failed hotel tech integration, why tech first hotel models are so fragile, and how expert integrators or Managed IT Services Providers and Cybersecurity Experts such as Arcadion could have changed the outcome. By the end, you will have a practical playbook to avoid a Sonder-style collapse in your own hospitality tech partnerships.

Background: Sonder’s Tech First Hotel Model And Rapid Rise

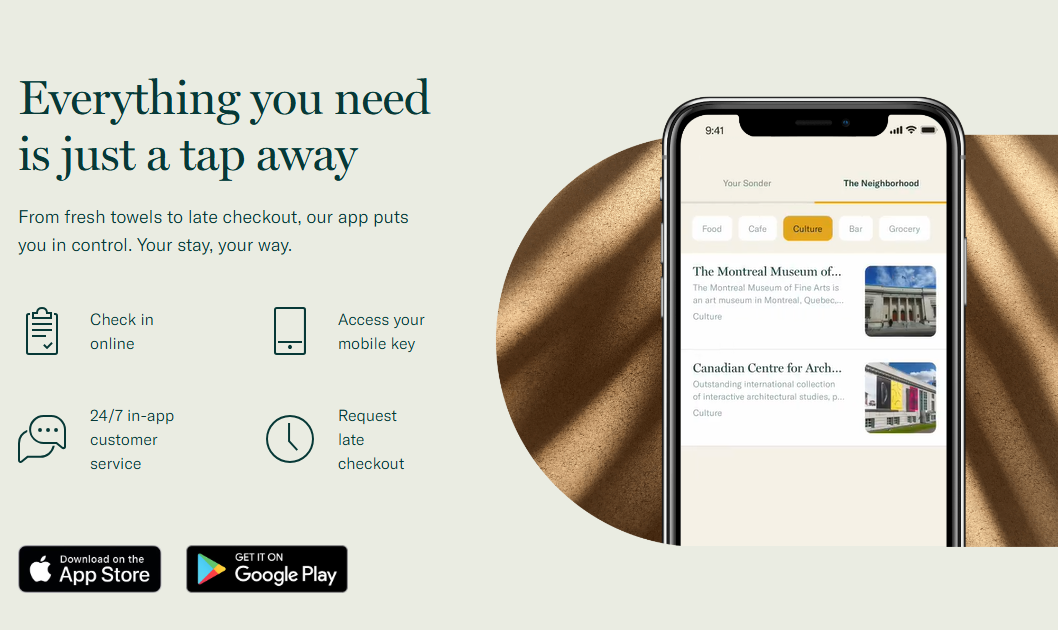

Sonder began as a tech first hospitality startup positioned between hotels and short-term rentals, using an app-driven, self-service guest experience to offer apartment-style units with hotel-like consistency and centralized operations. That sleek story helped push its valuation above a billion dollars, even though it rested on an asset and lease-heavy model built on master-leasing buildings, furnishing units, and carrying long-term obligations that only worked if occupancy and pricing stayed strong.

As travel patterns shifted, costs rose, and losses continued even after its 2022 SPAC listing, Sonder faced mounting pressure from Nasdaq and shrinking access to capital. In that fragile state, any disruption to a major partnership or tech integration could tip the whole structure, which is exactly where the Sonder by Marriott Bonvoy deal came in.

Inside The Sonder By Marriott Bonvoy Partnership And Tech Integration Plan

On paper, Sonder and Marriott looked perfectly aligned. Marriott wanted flexible, apartment-style units for extended stays and younger travelers, while Sonder needed stable demand, brand credibility, and access to Bonvoy loyalty members. The partnership promised benefits on both sides.

Why Marriott Wanted a Tech Forward Partner

Marriott saw Sonder as a fast way to offer modern, apartment-style stays supported by a digital, self-service guest experience. Sonder brought the inventory and the tech; Marriott brought global scale, loyalty integration, and massive distribution power. If successful, Sonder would become a valuable engine inside Marriott’s network.

How the Integration Was Supposed to Work

To deliver that value, Sonder’s booking and property systems had to integrate deeply with Marriott’s legacy CRS and loyalty infrastructure. That meant shared availability, synchronized rates, unified guest data, and clean payment flows. This was a complex hospitality tech integration, not a simple “list us on Marriott.com” arrangement, which is why analysts now point to this integration as the core failure behind the Sonder by Marriott Bonvoy breakdown.

If you’re planning a similar partnership, have an independent integrator review your architecture early, then then connect with Arcadion’s fully managed IT services team or reach out through the Arcadion contact page to shape a more resilient integration plan.

Where The Technology Integration Failed

What Went Wrong With The Sonder by Marriott Bonvoy Tech Integration?

At a high level, the Sonder by Marriott Bonvoy tech integration failed because the planned connection between Sonder’s modern booking stack and Marriott’s legacy reservations and loyalty systems never reached full, stable scale. What looked like a straightforward way to plug a tech first hotel startup into a global brand became a slow, expensive effort dogged by misaligned expectations, technical friction, and governance gaps.

From the outside, it is tempting to summarize the story as “Sonder bankruptcy after Marriott ends partnership.” Inside the project, the reality seems closer to a tangle of integration delays, misaligned expectations, and mounting operational headaches that never truly resolved.

Read More: For lessons on reducing reliance on fragile cloud infrastructure, see the AWS outage analysis.

Modern Stack Meets Legacy Infrastructure

Sonder had a relatively modern, API-driven environment. Marriott’s core platforms evolved over decades and support thousands of properties around the world. Joining those worlds meant wrestling with incompatible data models for room types and rates, legacy interfaces that did not match Sonder’s assumptions, and performance constraints that show up when you plug into a global reservations system.

Media reports have described unexpected challenges in aligning technology frameworks that delayed the rollout of Sonder properties inside Marriott channels. Every month of delay meant Sonder saw less revenue than projected from the Sonder by Marriott Bonvoy partnership. That growing gap between planned integration and reality sits at the heart of the Sonder Marriott partnership collapse.

| Planned integration outcome | What actually happened |

| Fast listing of Sonder units across Marriott channels | Rollout delays as systems struggled to align |

| Predictable revenue lift from Bonvoy demand | Revenue shortfalls as rooms did not appear or sync as expected |

| Stable data flow between booking, loyalty, and payments | Ongoing issues reconciling reservations, guest data, and cash flow |

Governance, Scope, And Change Management Gaps

Technology alone did not sink the project. Governance and scope control did as well. When a startup leans hard into a tech first hotel identity, it can underestimate how complex it is to align with a global giant that operates on slower, more risk-averse processes and stricter change controls.

In many large integrations, definitions of “done” are vague, there is no single accountable owner on each side, decisions on technical issues drag out, and timelines become more wish list than plan. Everything takes longer. Everything costs more. Everyone silently assumes the other side will bend. That pattern matches the hospitality tech integration failure Sonder is now famous for.

Cost Overruns and Loss of Working Capital

Delayed integration meant delayed revenue. At the same time, Sonder kept funding integration work and running operations sized for demand that never fully materialized through Marriott channels. Leadership later cited significant, unanticipated integration costs and a sharp decline in expected revenue from the relationship, which together caused a major loss of working capital.

In plain language, cash was going out faster than it was coming in, and the balance sheet was already stretched by lease obligations and debt. This is where “chapter 7 Sonder Holdings what went wrong” stops being a theoretical SEO phrase and becomes the brutal math that forces a company into liquidation.

If your revenue forecast depends on a complex integration going smoothly, use Sonder as a stress test for your own plan, explore Arcadion’s fully managed IT services or contact us to walk through a more resilient integration strategy.

From Partnership Breakdown to Sonder Bankruptcy and Tech-Driven Liquidation

Once the integration did not deliver, the Sonder by Marriott Bonvoy partnership shifted from lifeline to liability. The story that began as a growth narrative turned into a scramble to manage fallout.

Marriott eventually terminated the licensing deal, pulled Sonder properties from its ecosystem, and signaled that it no longer believed the partnership could achieve its goals. Without that support, Sonder lost a crucial demand engine and the reputational glow that comes from being aligned with a global brand.

Meanwhile, outlets like CBC and BBC documented the human side of the collapse: guests told to vacate on short notice, families hauling luggage to the sidewalk, and influencers filming frantic calls to customer support in real time. Employees experienced similar shock, with many learning about the Chapter 7 filing and liquidation on short notice and with limited clarity about severance or next steps.

With limited access to new capital, mounting lease obligations, and no credible path back to growth, Sonder filed for Chapter 7 in the United States and began insolvency processes in other markets. From an investor or operator perspective, the Sonder bankruptcy and liquidation are the visible outcome of a deeper chain: a fragile, asset heavy model, overreliance on a single partner, and a failed tech integration that drained working capital.

Lessons And Playbook: Avoiding A Sonder-Style Tech Integration Failure

Sonder’s story hurts, but it is a useful warning. If you work in hotel tech, short-term rentals, or brand partnerships, this is a live case study in how a promising deal can break when tech integration is not treated seriously enough. At its core, leaders searching for “lessons from Sonder bankruptcy for hotel tech” are asking how to avoid the same trap.

Lesson 1: Treat Integration as Core Strategic Risk

Integrations with a major partner are not side projects. For a hospitality business that depends on them for demand, they are revenue engines and survival variables, so they belong on the board agenda and in financial models. Ask directly: what if this integration takes six to twelve months longer than planned, or never reaches full scope—does the business still hold together?

Lesson 2: Be Honest About Tech First Hotel Fragility

Tech first hotel startups look great on slides, but an asset and lease heavy model is unforgiving when something breaks. Lease payments, staffing, and fit-out costs keep coming even if a key integration stalls or demand shifts. Leaders who lean into the tech first narrative need equally clear-eyed modeling of lease exposure, funding needs, and integration risk.

Lesson 3: Bring MSPs And Integrators in Early, Not as Firefighters

A recurring theme in the Marriott–Sonder integration failure is the lack of an independent, experienced integration specialist steering the project. An industry-focused MSP can sit between a startup and a global brand, map both sides’ systems before contracts are signed, flag where data models and legacy interfaces will clash, and design a phased rollout with real pilots and rollback options. With an MSP embedded early, integration risk is surfaced and priced into the deal instead of lurking as a surprise.

Lesson 4: Build Models That Survive Integration Delays

Even with strong partners, some integrations will slip. A resilient model expects that and does not rely on the most optimistic timeline. For hospitality tech leaders, that means planning for a slower Sonder by Marriott Bonvoy style ramp-up, sharing integration risk more fairly in contracts, keeping enough liquidity to cover leases and staff through delays, and diversifying demand so one partnership cannot decide the company’s fate.

If you are scoping a major hotel tech integration or brand partnership, bring your MSP or integration partner into the room now and consider scheduling an integration readiness review with Arcadion by contacting our team, using the Sonder case as a reference point rather than distant gossip.

Turning Sonder’s Tech Integration Collapse into Your Playbook

Sonder’s story is a warning. A tech first hotel model, long leases, tight cash flow, and a complex Marriott Bonvoy integration meant that when the rollout faltered, survival did too. Integration risk became business risk.

Treat that as your checklist. Put major integrations on the board agenda. Test what happens if a rollout is late, scaled back, or never finished. Be honest about how much you rely on one partner or channel. Bring experienced MSPs and integrators in early. The gap between a Sonder-style bankruptcy and a smooth launch often comes down to the discipline you apply before you sign.

Ready to talk about your tech integration? Reach out to Arcadion

If you are planning a new hospitality tech partnership or wrestling with integrations that already feel fragile, this is the moment to act. Share the Sonder case study with your leadership team, then connect with Arcadion to review your current integration roadmap. You can start the conversation with Arcadion’s fully managed IT services team or contact us directly through the Arcadion contact page to design a path where your technology becomes a durable advantage instead of a hidden fault line.